The RPGT rates are as follows-. The gain is payable when the resale price disposal cost of the property is higher than its purchase price acquisition cost.

Real Property Gains Tax Rpgt Gl Property Consultancy Facebook

Further to the above on 1 st January 2018 the Finance No2 Act 2017 came into effect with amendments to the Real Property Gains Tax Act of 1976.

. The Real Property Gains Tax RPGT is tax on profits made from the sale of real estate. Real property is defined as any land situated in Malaysia and any interest option or other right in or over such land. For detail of informstion on RPGT reference can be made to the RPGT Guidelines dated 13062018 or 18062013 whichever.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Home real property gain tax 2018. In tandem with the Governments aspi ration to modernise the tax syst em it was proposed in Budget 2015 that tax on gains from the disposal of property be self-assessed by the taxpayer effective from the year.

As RM 20000 is higher so we use RM 20000. Based on the Real Property Gain Tax Act 1976 RPGT is a tax on chargeable gains derived from disposal of property. Introduction The Finance No 2 Act 2017 FA received royal assent on 27 December 2017 and was introduced to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 RPGTA the Goods and Services Tax Act 2014 and the Finance Act 2013.

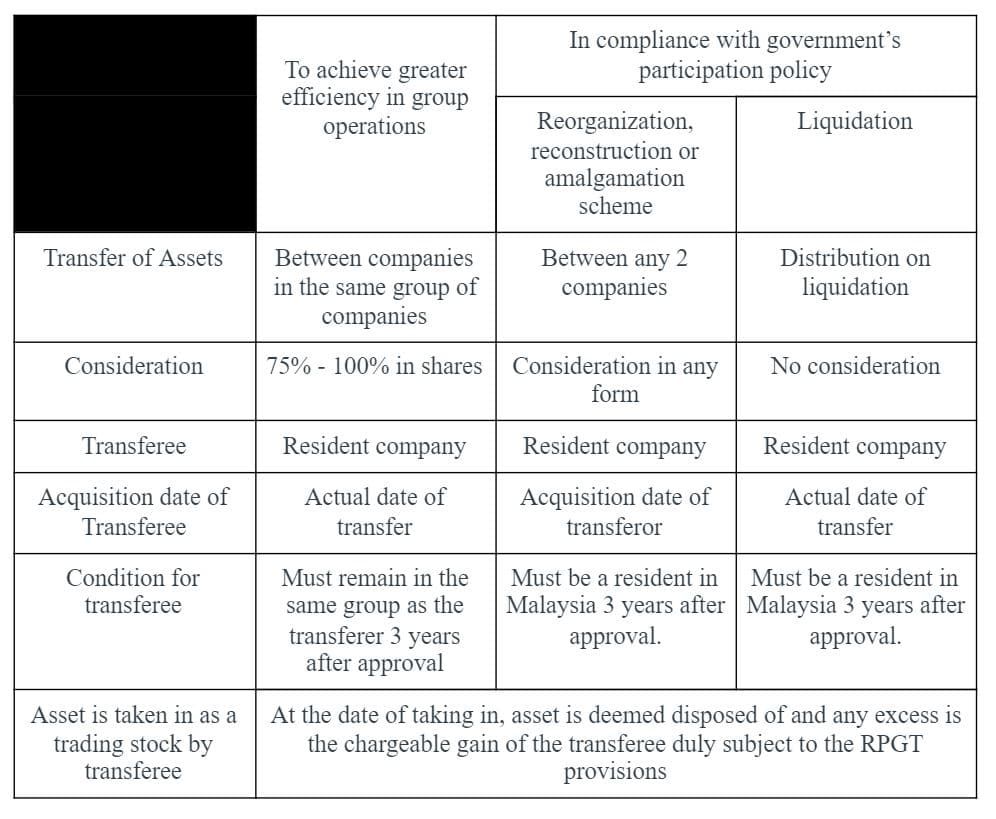

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. The Real Property Gains Tax Exemption No3 Order 2018 which was gazetted on 31 December 2018 exempts any individual who is a citizen or permanent resident of Malaysia from payment of real property gains tax on the chargeable gain accruing on the disposal of a chargeable asset excluding shares in a real property company if the following conditions are. Currently gains from the disposal of property under the Real Property Gains Tax Act 1976 are assessed formally.

Essentially RGPT is a tax levied on chargeable gains from the disposal of chargeable assets such as houses commercial buildings farms and vacant lands. A 360 and the RPGT Amendment Order 2021 the government has taken steps to aid Malaysians by exempting them from paying RPGT if they sell their properties after 5 years or more after. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974.

Central Bank of Malaysia. Individual Citizen PR Individual Non-Citizen For Disposals Within 3 years. 2 April 2018.

Budget 2022 RPGT Change Removed the 5 RPGT for properties held for more than five years by Malaysian citizens and permanent residents effective 1st January 2022. Youve got questions Weve got answers. RGPT was first introduced by the Malaysian Government under the.

The disposal is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter. It was suspended temporarily in 2008-2009 and reintroduced in 2010. The Real Property Gains Tax RPGT in Malaysia is definitely not a new subject for property owners veteran investors especially.

For example if you bought a house for RM250K and sell it at RM350K the profit of RM100K is chargeable under RPGT but you may be entitled to deduct expenses such as. RPGT Payable Nett Chargeable Gain x RPGT Rate. Third according to the RPGT Exemption Order 2018 PU.

That means it is payable by the seller of a property when the resale price is higher than the purchase price. RPGT applies to both residents and non-residents. RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

What is Real Property Gain Tax RPGT. The Real Property Gains Tax Exemption Order 2018 PU. The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble.

Gallery Real Property Gain Tax RPGT 2019 Latest News and Update. This Order does not exempt an individual from the requirement to submit the relevant return under the Real Property Gains Tax Act 1976. Real Property Gains Tax RPGT Rates.

Contact Us At 6012-6946746. A 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property gains tax RPGT on the chargeable gain derived from the disposal. It is the tax which is imposed on the gains when you dispose the property in Malaysia.

From the period of 112014 until 31122018 disposal in the sixth year after the date of acquisition of the chargeable asset is nil. Malaysian citizens and permanent residents will no longer have to pay RPGT when selling their property on the sixth year onwards. RPC is essentially a controlled company where its total.

Real property gain tax 2018. A chargeable gain is the profit when the disposal price is more than purchase price of the property. Pursuant to the amendments it is worth noting that if.

RPGT Act Through The Years 1976 2022 RPGT is a tax on profit. Thus your final chargeable gain is RM 180000 3 If you sell your property on the 6th year onwards the RPGT applicable is 5 of RM 180000 which is RM 9000. RPGT stands for Real Property Gains Tax.

Real property gains tax exemption on the disposal of low-cost medium-low and affordable residential homes. Real Property Gain Tax RPGT 2019. The consideration for the disposal of the chargeable asset is not more than RM200000-.

Disposer is a company incorporated in Malaysia or a trustee of a trust or body of persons registered under any written law in Malaysia.

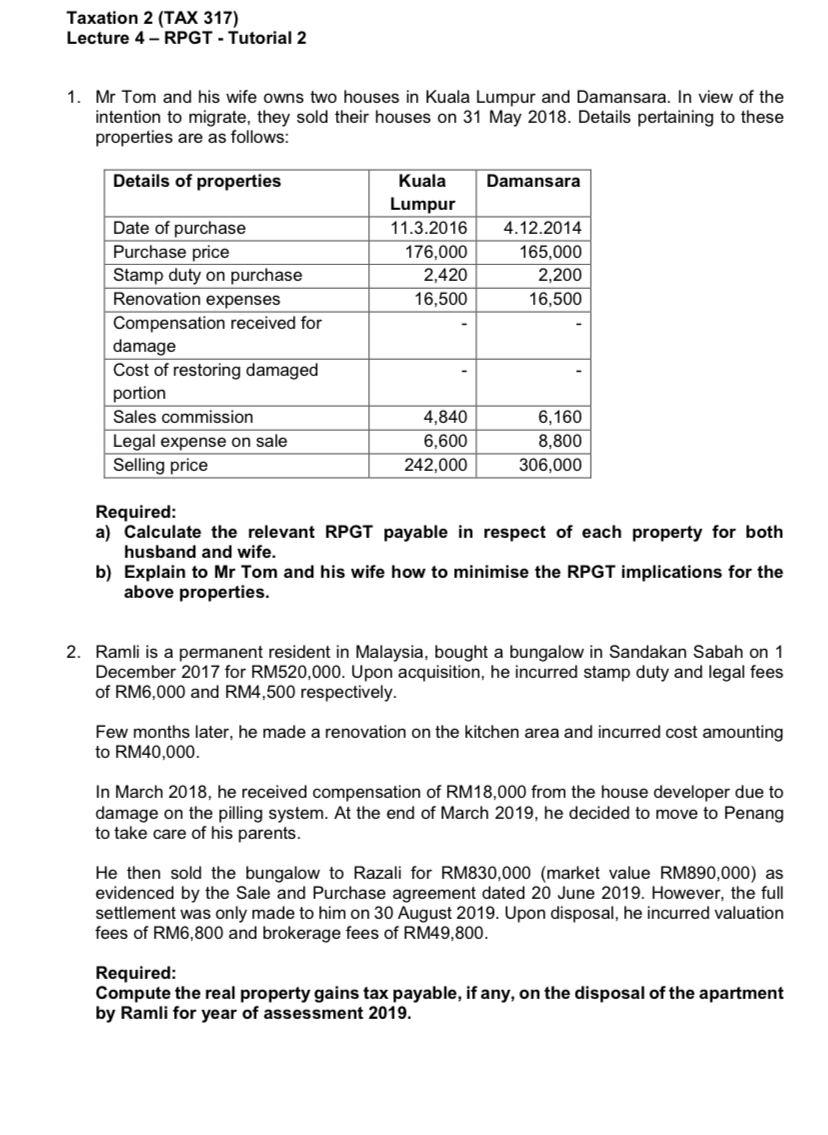

Taxation 2 Tax 317 Lecture 4 Rpgt Tutorial 2 1 Chegg Com

Property Tax Malaysia Www Peps Org My

Key Changes In The Real Property Gain Tax Cheng Co Group

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Guide To Malaysian Real Property Gain Tax Rpgt

An Insight Into Real Property Gains Tax Rpgt Properly

Zerin Properties Real Property Gains Tax

What We Need To Know About Rpgt

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

All You Need To Know About Real Property Gains Tax Rpgt

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

An Insight Into Real Property Gains Tax Rpgt Properly

What Is Real Property Gains Tax The Malaysian Bar

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

6 Steps To Calculate Your Rpgt Real Property Gains Tax

Key Changes In The Real Property Gain Tax Cheng Co Group